rsu tax rate texas

Although the rate is lower. Taxes are usually withheld on income from RSUs.

Rsu Taxes Explained 4 Tax Strategies For 2022

Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

. At any rate RSUs are seen as. How much you pay will depend on the amount of time that passed between the day they vested and the day. Unlike actual dividends the dividends on restricted stock will be reported on your W-2 as wages.

Typically 25 is withheld for federal income tax 62 for SS and 145 for medicare. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Carol nachbaur april 29.

For one a recipient cannot sell or. The first way to avoid taxes on RSUs is to put additional money into your 401 k. Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self.

Companies can and sometimes do pay dividend equivlent payouts for unvested RSUs. Step 5 - Review Outputs of RSU Tax Calculator. Marginal Federal Tax Rate You can.

Restricted stock units rsus tax calculator apr 23 2019 0 hope you had a chance to glance over at the official restricted stock unit rsu strategy. 15 hours agoThe new rate is nearly 14 percent lower than the previous rate of 0436323 though it is higher than the no-new-revenue rate of 0363244. You have 5000 of taxable ordinary income that will be included in your companys W-2.

The stock is restricted because it is subject to certain conditions. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax.

Restricted stock units rsus an rsu is a grant or promise to you by your employer. How Are Restricted Stock Units RSUs Taxed. Here is an article on rsu tax.

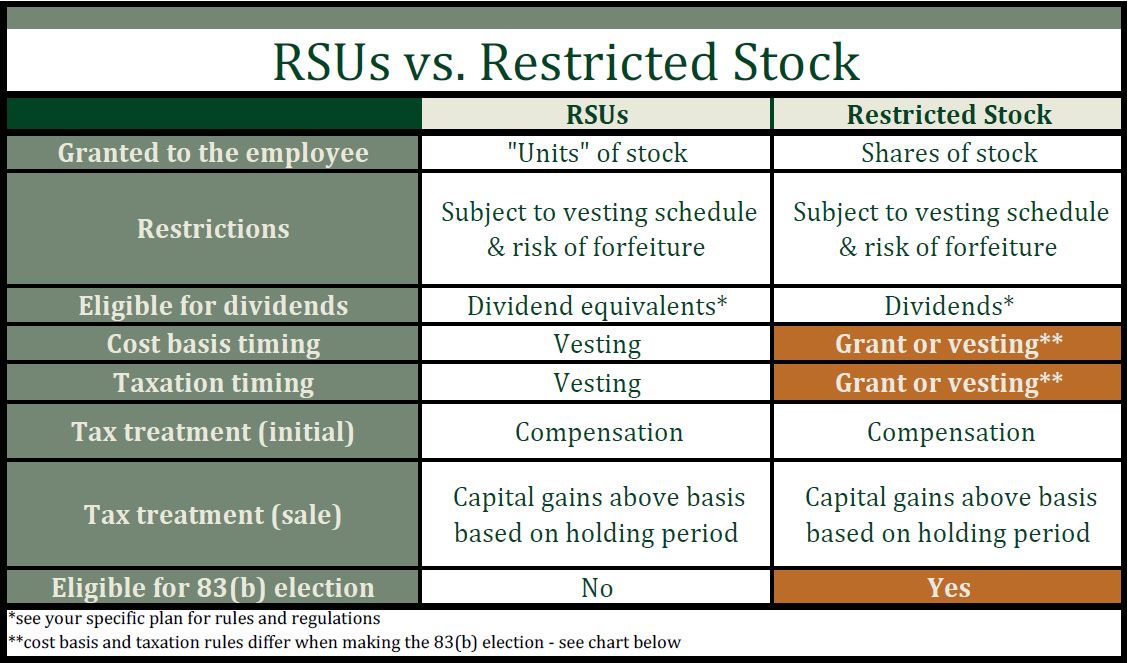

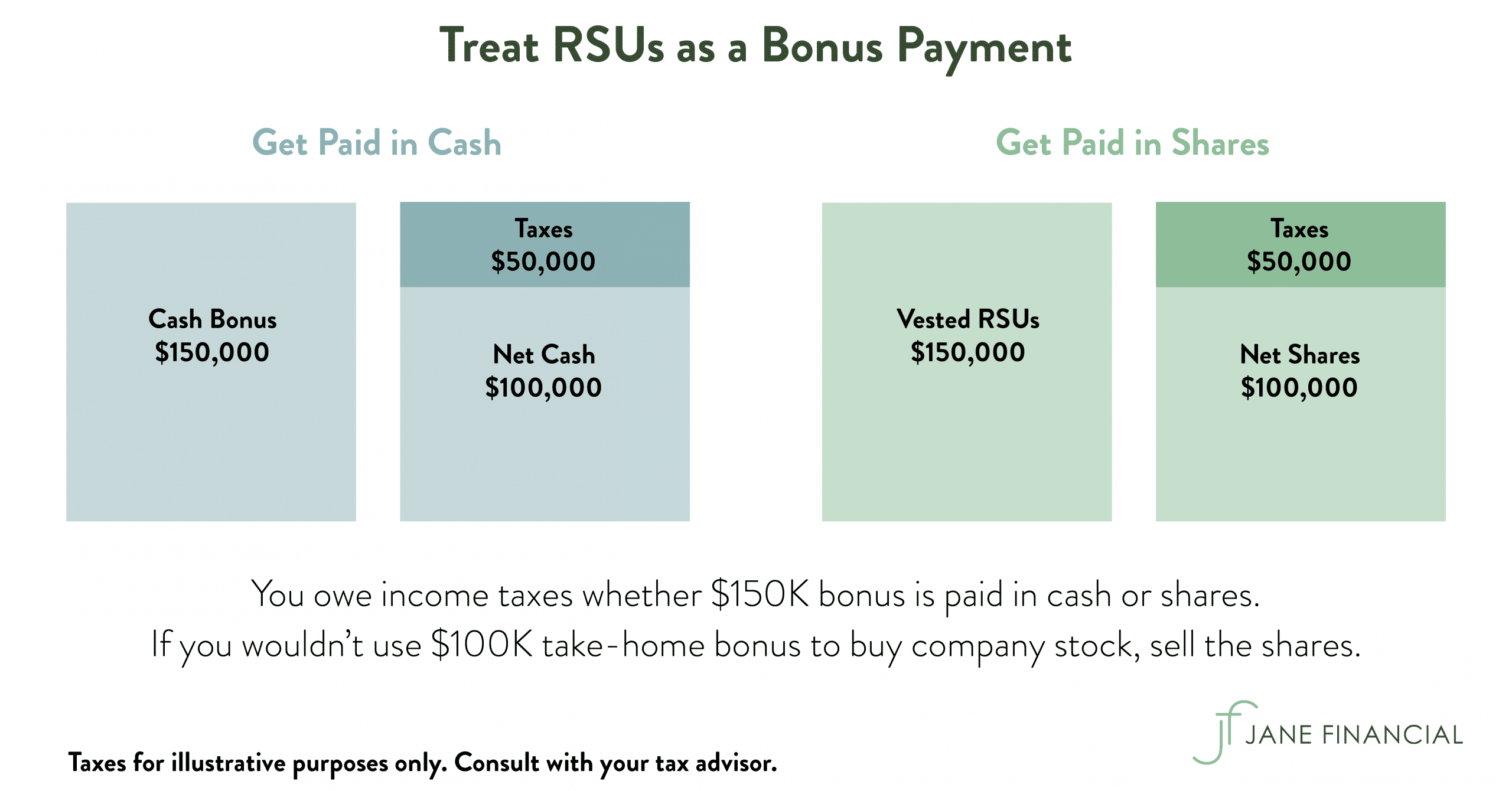

Taxes you pay when you sell are called capital gains taxes. This is different from incentive stock. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

Youll be required to pay the ordinary income tax rate on your gains. Avoid Taxes on RSUs Tip 1 - Max Out Your 401 k on a Pre-tax Basis. Restricted stock is a stock typically given to an executive of a company.

Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy.

Equity Compensation And The Rise Of Restricted Stock Units Blogs Manufacturing Industry Advisor Foley Lardner Llp

Common Rsu Misconceptions Brooklyn Fi

Rsu Tax How Are Restricted Stock Units Taxed In 2022

Tax Accounting And Startups Rsus Restricted Stock Units

Restricted Stock Units Rsus Merriman

Restricted Stock Units Jane Financial

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Restricted Stock Units Everything You Need To Know Open Advisors

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic

Rsus In A Ceo Compensation Package Attorney Robert Adelson

Offer Letter Dated February 11 2020 Between The Company And Shutterstock Inc Business Contracts Justia

What You Need To Know About Restricted Stock Units Rsu Kinetix Financial Planning